Monday, March 21, 2022

74. What is your objective every time you make a presentation?

Wednesday, March 16, 2022

73. This "savings" mindset may be what is keeping you poor

You decided to save 10,000, and just like before, you deposited the money to your savings account

the question now is, did you "save" or "invest"?

the decision to save money and where you decided to keep it are two different issues

if you retained "possession", its your savings

as soon as you transfer "possession", you are effectively entrusting that money to another party, in effect, you are already investing, so the act of depositing it to your savings account means you are no longer in possession so there now exist a possibility, albeit minimal of the chance of not being able to get in back

the main benefit proposition of a savings account - "liquidity" (the ability to withdraw it anytime, 24/7) creates an illusion of possession

understanding this difference would be vital in wealth building

first is that once you realized that every time you make a deposit - you are already in fact investing, this would changed your expectations in terms of the returns that you are getting

sure we need the liquidity, but keeping most of our savings in a savings account is counter productive, as the returns we are getting is not enough to offset the eroding effects of inflation

the "advice" is just to keep an amount equal to three to six months of your average monthly expenses and invests the excess in other forms of investments - investments that have the potential of beating inflation

all the best my friends!

#acgadvice

Tuesday, March 8, 2022

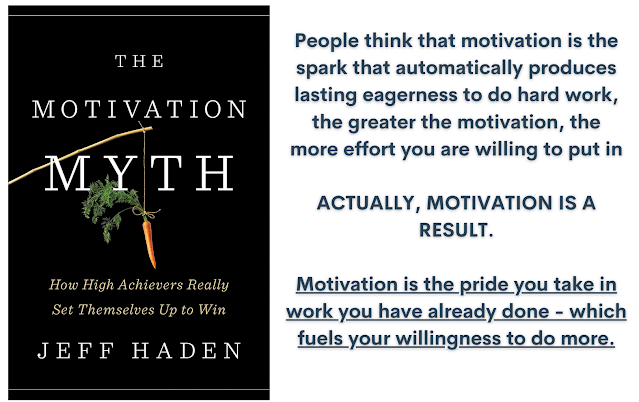

72. Celebrate the small wins! it will bring you closer to the "BIG" one!

As financial advisors, what are the "small wins" that will motivate us to go further?

it could be a meaningful conversation with a prospect, sharing financial insights that can help in widening his understanding of the pros and cons of acting/not acting in starting to prepare for his important life goals

- will accomplishing more of these "encounters" bring you closer to your goals?

- does this give you a sense of satisfaction of a job well done?

- celebrate this as a small step that leads to a bigger one!

then it could be that prospect that decides to be a client by getting his first insurance policy even if he is starting with the "minimum" premium

- your hard work is paying off

- you have just helped one family take their first step to financial security

- celebrate this small step that gives meaning to our financial advisory practice!

the client turned to a satisfied client and started referring you to his friends because he found so much value in your advice, he is especially very appreciative that you took time to explain to him that the current market volatility brought about by the Russian conflict is just a small blip and the market usually resume its upward bias in time

the three most important events in our practice that we should celebrate are:

- A meaningful financial conversation with a prospect

- the prospect that turns into a client

- the satisfied client who refers you to his friends and associates

All the best my friends!