OF THESE:

- 9.33 Trillion pesos is in 2 million accounts with balances of 500,000 and above

- over 580,000 accounts have balances of 2 million pesos or more,

one of the most attractive feature of a savings account is its "liquidity" - that it is withdrawable anytime, but as I have pointed out in an earlier post, liquidity is not a benefit that we enjoy for FREE, being withdrawable anytime comes at the cost of not earning enough to offset the effects of inflation

the prudent rule of thumb for the "liquidity component" of a personal portfolio is a level equivalent to is 3 to 6 months of their average family monthly expense, maybe keep a month or two on the side as "emergency fund", anything in excess is best diversified away (invest in other asset class) to preserve overall value.

The data above shows that there would be quite a number of account holders who are unaware that the value of their hard-earned savings is being continuously eroded by inflation, over time, this could snowball to a very significant amount

I sometimes asked participants in my seminars how long have they been keeping their hard earned money in a savings account, I am not surprised to hear answers of "as long as twenty years or more than twenty years..",

Over twenty years, at negative 2% (0.5% interest earned vs 2.5% inflation) the compounded loss of value can be as much as 60%!!!

This is where financial advocacy comes in:

the objective of financial advocacy is to provide "savers" with information to improve their understanding of financial products, services and concepts, so they are empowered to make informed choices, avoid pitfalls, and take other actions to improve their present and long-term financial well- being. (PACFL, 2008)

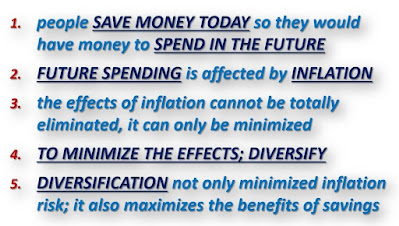

Write your advocacy statement, this will be your guide every time you have the opportunity to advocate to people, let me share my own 5-point advocacy statement

As you gain more experience in your advocacy, you will notice that you would be able to expand the scope of discussion per advocacy point, this would make you more compelling and effective, practice till you can already say it from the heart

all the best my fellow advisors!

#acgadvice

No comments:

Post a Comment